|

Weekly Updates & Forecasts - February 20082-24-08 WEEKLY UPDATEGold:Well, well, well. Gold is getting mighty close to the $1000 level, but not yet. I think we will see a small correction first before that happens. The price movements have decreased in amplitude over the last two days of the past week, and that’s a sign that gold will take a breather, more likely than not.

Silver:Silver keeps on outperforming gold, which is very bullish for gold, generally. Silver has now traced out a very nice u-shaped bowl pattern over the past twenty-some years, and it is not anywhere near its 1980 high of $50, not even in nominal terms. Industrial production demand has reportedly increased recently - but for what production processes? Might it actually be investment demand that caused this recent rise? Hmm.

Oil:Looks like last week’s call that oil may reach but not exceed the $100 mark for long was dead-on. Oil has now banged its head up against the $100 barrier for the second time and was beaten down again.

I’m not sure why people are so afraid of sky-high oil prices. I also don’t understand why the Arabs lowered their output. What are they thinking? Are oil prices not high enough for them? Or are they setting themselves up with a cushion against anticipated demand drops from the economic slowdown? They may well be shooting themselves in their feet by doing what they are doing. As the world economy slows due to the Fed-caused and derivatives-proliferated credit crunch, higher oil prices will definitely weaken the world’s economic outlook, and so contribute to the slowdown. But, then again, this may all be directed at kicking the good old USA in the shin under the table, so to speak. When they are raising their price, that means they are primarily raising the dollar price for oil since most oil is still traded for dollars. Since the dollar is falling against other currencies, their issuing countries have a much lower burden compared to the US. The DowThe good old Dow-Jones Industrial Average is looking very, well ... average, to say the least. Even its short term chart looks sooo tired.

Treasuries:The 30-year bond price has recovered a bit on Thursday and Friday, and so did the 10 year note. The main reason for that was supposedly the usual “safe haven bid” of stock investors exiting the markets, but that dog just don’t hunt no more. Friday actually saw a late rally because some banks said they might bail out one of those monoline bond insurer companies, so how can that have caused a bond rally?

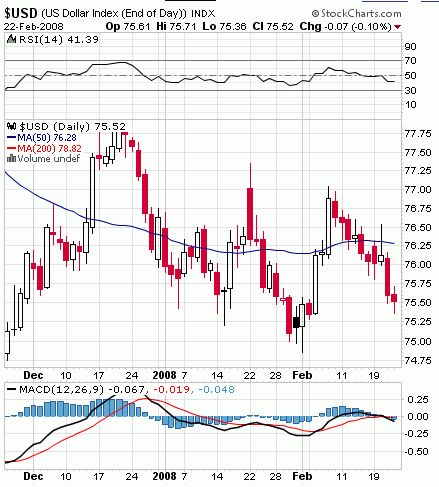

In either case, it will be “bye-bye” for high bond prices in the medium to long term. The DollarThe buck looks even sadder than the Dow. There isn't much to be said about it. It's not even worth drawing lines. Just look at the big, fat, downward sloping red lines it is drawing for you without any help from my part, and you get the story.

Gold:Gold continues to consolidate right at or above the $900 level. When it breaks out again, I see $1000 gold within the next two months as very possible.

It is supported by OPEC rumblings about possible production cuts at this time, but the demand side is definitely weaker now than it was late last year.

Silver:Silver keeps looking better and better. It has shaken off its malaise from last year and is powering ahead with only minor setbacks in a very nice, slick, steep, and narrow rising trend pattern. A silver ETF might be a good place to park your retrieved gold stock money at this time.

The Dow:All the while, the Dow is in its own, seriously declining, consolidation pattern from which it will likely break out to the downside, possibly as early as this week. On the other hand, it is difficult to estimate the psychological effect of further, depp, expected rate cuts from the Fed. Market participants are just too conditioned to regard these as "bullish", and so some trading up can be expected in the short term in anticipation of these.

See you next week.

Gold:Gold has definitely established its third uptrend slope since its secular bull market trend began back in 2001. The first slope lasted until June 2005, the second until August 2007, and we are currently establishing whether Slope 3 can hold or not.

Evidence for that is the fact that gold continues to rise and suffers only the briefest consolidations on the way despite the fact that Indian wedding season gold buying has all but ceased to occur and Indians already flush with gold have begun to sell their metal in exchange for empty paper promises. Investment demand has completely taken up that slack - and then some, and that despite US treasuries having achieved all time highs during the same period, indicating at least some buying from paper-investors seeking what in the fiat world goes as "safe haven" bids. Since the housing collapse and credit-crunch caused US economic slowdown is very likely to persist way past mid-year 2008, it is reasonable to expect at least the possibility of a "slump-less" year in gold. Interesting is also, in that connection, that Slope 3 will be maintained even if gold breaks back down all the way to the $850 level from where it is now ($920 at the time of this writing). Given the fact that the bond insurer crisis isn't even half over yet, and given the fact that the international credit ratings scandal hasn't begun to take hold in investors' minds yet, it is very possible that Slope 3 will in fact be maintained. It is, however, too early to tell. We will know when May/June comes around. Gold Stocks:Another level of proof will come in the form of the increasing popularity of gold stocks. When you start hearing your door man and you cab driver tell you which gold mines and exploration stocks he invests in, that's when you'll know that gold stocks will be the next bubble. Before then, despite the current level of press it receives, gold and gold stocks will still be a dark horse investment to most. Another indicator is whether the XAU will stop lagging behind gold and start passing it up. Right now, it is still sorely lagging. It is no higher than it was in October of last year - five months ago.

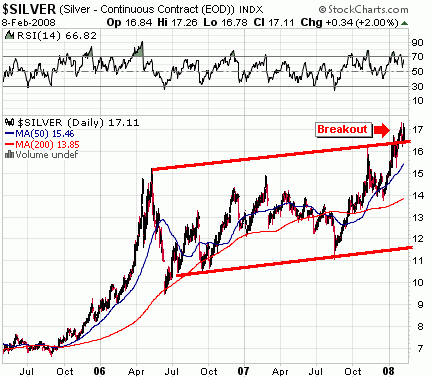

I am not going back into gold funds or stocks until I see an actual triangular consolidation pattern forming that puts an end to the megaphone formation we have discussed in the past. In the meantime, a gold ETF would be a much better place for your liquid investment cash. Silver: Lameout BreakoutSilver has done quite nicely of late. Its lame-out factor seems to be a thing of the past. It has shaken off the stench of mold and dry-rot it emitted as recently as December last year and has broken out of the broad, slow, and haltingly rising "lameout" trading channel established back in 2006.

The Dow:All the rate cuts in the world don;t seem to help the Dow much these days, at least not for very long. The chart is still within its inverted cup pattern and will likely continue to decline along the right edge of it.

However, ask yourself who will have money to spend on risky stock-market schemes? Much illusory wealth will be lost in the form of market-valuation. people will feel poorer, jobs will be harder to come by, loans will be increasingly hard to obtain despite lower short term rates, and the home-equity ATM is out of order indefinitely. The spare parts are missing and the repairman has absconded. The DollarOnFriday, the current secretary general of OPEC was overheard asking the rhetorical question: "Why don't we just sell the oil for the euro?" As a Monitor member, you know what that means. If you are new, you should know as well. Trillions of external dollars will reenter the US economy when that happens, even if it happens very gradually. In essence, Bush's and the neocons' ploy to intimidate OPEC into stying with the dollar by militarily intervening in the middle east under false pretenses - has backfired. It has made the US so economically unstable that even military pressure, though largely psychological, will not prevent this from occurring. The buck has enjoyed the dubious benefit of the the spreading of the US economic contagion to the rest of the world, putting downward pressure on growth expectations elsewhere, and therefore making the dollar "less weak" in comparison with currencies of other countries.

In fact, this recent "strength" stemming form less weakness is very destabilizing to the dollar. It allows the euro a much-needed breather from its recent run-up to near the $1.50 level, which it would not have been able to sustain. The recent weakness in the EU economies has made Trichet backtrack on his threats of having to raise the repo rate to combat price inflation there. That means the euro can conveniently continue to spread around the world in its creeping dollar-replacement bid. And that means the dollar is truly doomed. If you have any questions, please feel free to call me during normal business hours. My cell number is 832-452-9966. |