|

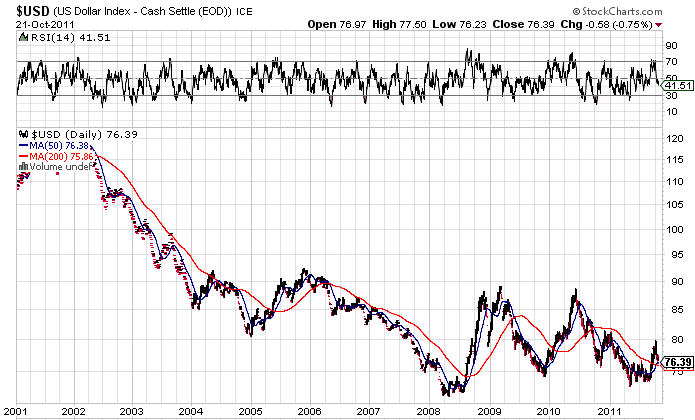

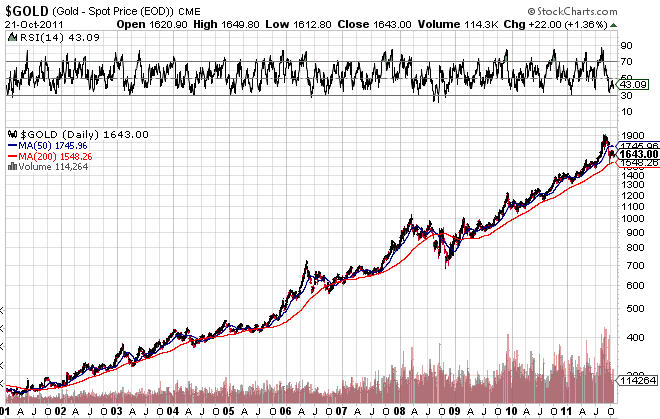

Gold vs DollarProtect Your Wealth from the U.S. Dollar's StrangleholdThe gold vs dollar charts below speak for themselves. They are up to date as of October 23, 2011. The evidence is profound: Gold is far more stable and less risky than the US dollar or US stocks (or any stocks, for that matter):

These gold vs dollar charts clearly show that gold is by far the superior investment. Do you like stocks? is your retirement investment portfolio mainly invested in US or international stocks? Then please visit this gold vs dollar sister page to see how other countries' stock exchanges have fared compared to gold.

Even US treasuries - although they fared markedly better than stocks, show a pattern of extreme volatility and unpredictability. It is clear that, in the battle between gold vs dollar-denominated assets, gold wins.

Currently, US treasuries only remain as high as they are because the Federal Reserve is back-stopping them and because the US dollar remains the only viable reserve currency of the world while the euro is fighting for its life. Yet, China, as the world's largest holder and buyer of US treasuries, has already announced that it intends to cycle out of the dollar and push for an alternative reserve currency. That, combined with the excessive US debt load and recent S&P international ratings downgrade, can only have one result: a crash. Now compare the steady, straight line, unperturbed rise of gold vs dollar during the last decade to all of the above (if you want to compare gold to other countries' stock markets, please click here): Here is a chart of the dollar from 1973 to 2008:

... and here is a taste of the dollar's deterioration in purchasing power since 1913 - the date the US FED was created:

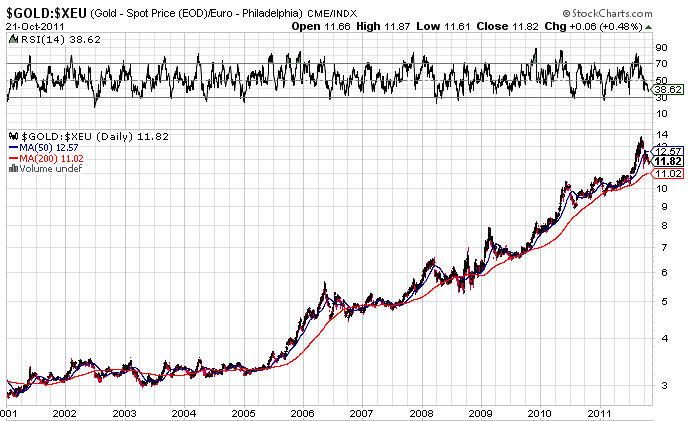

Do you get the picture? Yet, the dollar is not the only currency falling against gold. Gold rises against all currencies, and even against (still) the strongest of all currencies at this point, the euro:

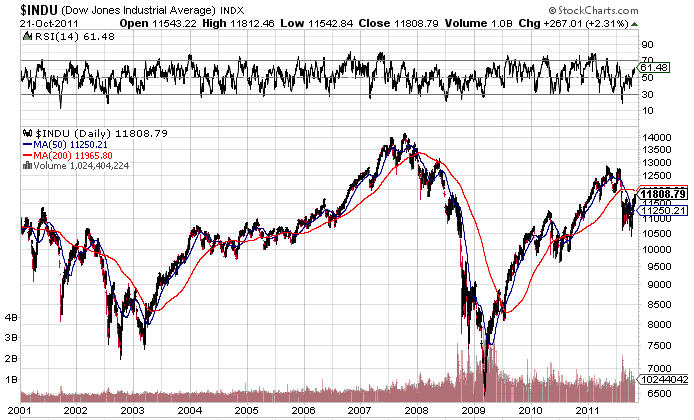

But the euro teeters on the precipice of collapse. Gold will never collapse because it has never been artificially propped up. If you have (so far) believed the lie that gold is a "risk trade", please revisit the gold chart above and compare it to the Dow-30 chart ("$INDU"), and then decide which trade is more volatile and "risky": Gold, or US blue-chip stocks.

|